When you go to a lender or service to ask for credit, it is of utmost importance for them to know how safe it is to deal with you. How do these services know if you pay your bills on time or not?

A lender service will not entertain you unless it has proof of your credibility. Otherwise, by providing you a loan or service without any credit reference is like putting their own business at risk!

This is where a credit reference letter helps provide you with a solution.

What is a credit reference letter?

A credit reference letter is a letter that a potential borrower needs to validate his/her credit worth. A credit reference letter is from a financial institution or a bank to substantiate a positive credit record.

Whether you are an individual or a business, you are eligible to ask for a credit reference letter from a financial entity with whom you have been associated for a certain time period. A credit reference letter plays a vital role in assuring a third party of your trustworthiness in terms of making your payments on time.

A credit reference letter also comes with certain terms and conditions. You must accept and agree to all of these as a business or individual.

When do you need a credit reference letter?

A credit reference letter serves multiple purposes and can be needed for a variety of reasons. Starting a business is one of the most common reasons why you’ll need a credit reference letter.

When you want to set up a new business, especially in a foreign land, you’ll need to prove your credit worth. In such cases, you can request for a credit reference letter from your bank. It is only through a credit reference letter with a bank with whom you are associated for a period of time that you will be able to prove your credit worth.

You might also need a credit reference letter to prove your credit worthiness to an individual, a bank, an investment or financial institution. On the whole, a credit reference letter is an extremely important document, both from the point of view of a consumer and business.

Role of the bank in your credit reference letter –

A credit reference letter is extremely important to prove your credit worthiness as an account holder. It is only with the help of a credit reference letter that you can prove that you can meet your financial obligations without fail.

As a credit reference letter holds an opinion about your financial ability as a account holder, it works as a foundation for your future business prospects. When it comes to a credit reference letter for banks, not all details are given by the bank. It generally contains a basic summary of your financial relationship with the banking organization, which is then used to form a measured opinion about your financial abilities.

So the bank plays an ultimate role in evaluating the potential risk that might incur as the account holder will lend money from a third party. This third party could be a potential business partner, a letting agency, a company or any other financial entity.

The ultimate aim of the bank is to protect you as an account holder. As a result, the information handed over to the third party is mostly of general nature.

How do you obtain a bank reference letter?

You can obtain a bank reference letter either with the help of a third party or by yourself. The third party through which you can request a credit reference letter is a lending agency. This agency or organization will put up a formal request to your bank to ask for a credit reference. To put up this request, it is important to have a written permission by the account holder.

In most cases, it is the third party that requests a credit reference from the bank. The third party will need official documentation and a consent form to complete the request process. Once the third party obtains the request form and fills in the details, it is further sent to the account holder for consent. Finally, the request is forwarded to the bank.

Important things to include in a credit reference letter –

- Do not miss out on mentioning the period of time for which you have been associated with your bank or any other financial entity.

- Your credit reference letter is incomplete without a brief payment history. This section of the letter must tell how regular are with making your payments on time.

- The letter should also disclose if you have a record of late payment in the past. If you have had late payments, your credit reference letter must also mention the total number of all your late payments.

- Make sure to mention the type of service or products you mostly purchase using your credit money.

- A credit reference letter must also clearly mention all the important terms and conditions of credit.

- Make sure to mention the total amount you have paid throughout your association.

Tips for writing an effective credit reference letter –

While writing a credit reference letter, you need to be mindful with a lot of things. Here are some useful tips that will help you draft an effective credit reference letter for banks.

- A credit reference letter should be to the point and include only pertinent information.

- Never deviate from the main objective of your credit reference letter, maintaining an absolute professional, civil and polite tone throughout the document.

- A credit letter should not boast about your financial worth and credibility.

- Make sure that all the information in your credit reference letter is accurate and factual, without any predictive statements.

- You need not write a lengthy credit reference letter. What matter the most is that all the requested facts are included in the letter.

- Maintain a professional and civil tone throughout your credit reference letter.

- The objective of your credit reference letter should be stated very clearly.

- Certain institutions issue a fixed template for writing a credit reference letter. In such cases, always make a point to stick to the mentioned format.

- A credit reference letter must be written on your bank’s letterhead, with proper signatures by the bank officials.

Credit Reference Letter Samples for Banks

Looking for help to writing an effective and appealing credit reference letter for banks? These credit reference letter samples will serve you as a guide. Check out these top credit reference letter samples for banks –

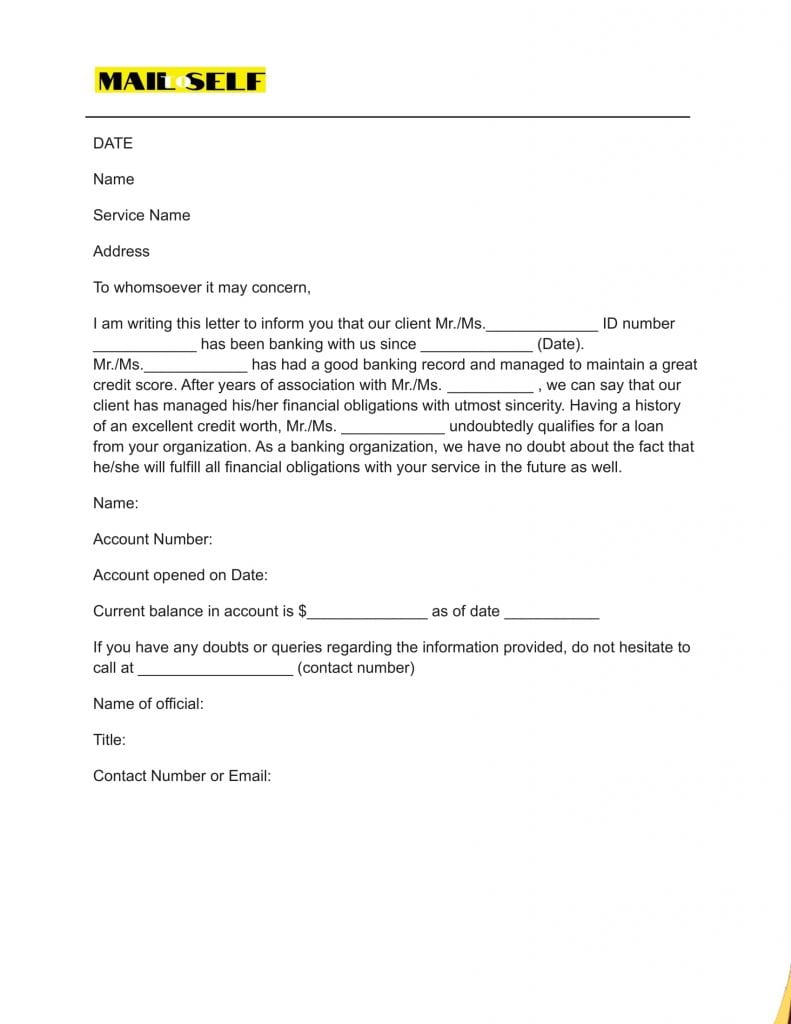

Template #1

DATE

Name

Service Name

Address

To whomsoever it may concern,

I am writing this letter to inform you that our client Mr./Ms._____________ ID number ____________ has been banking with us since _____________ (Date). Mr./Ms.____________ has had a good banking record and managed to maintain a great credit score. After years of association with Mr./Ms. __________ , we can say that our client has managed his/her financial obligations with utmost sincerity. Having a history of an excellent credit worth, Mr./Ms. ____________ undoubtedly qualifies for a loan from your organization. As a banking organization, we have no doubt about the fact that he/she will fulfill all financial obligations with your service in the future as well.

Name:

Account Number:

Account opened on Date:

Current balance in account is $______________ as of date ___________

If you have any doubts or queries regarding the information provided, do not hesitate to call at __________________ (contact number)

Name of official:

Title:

Contact Number or Email:

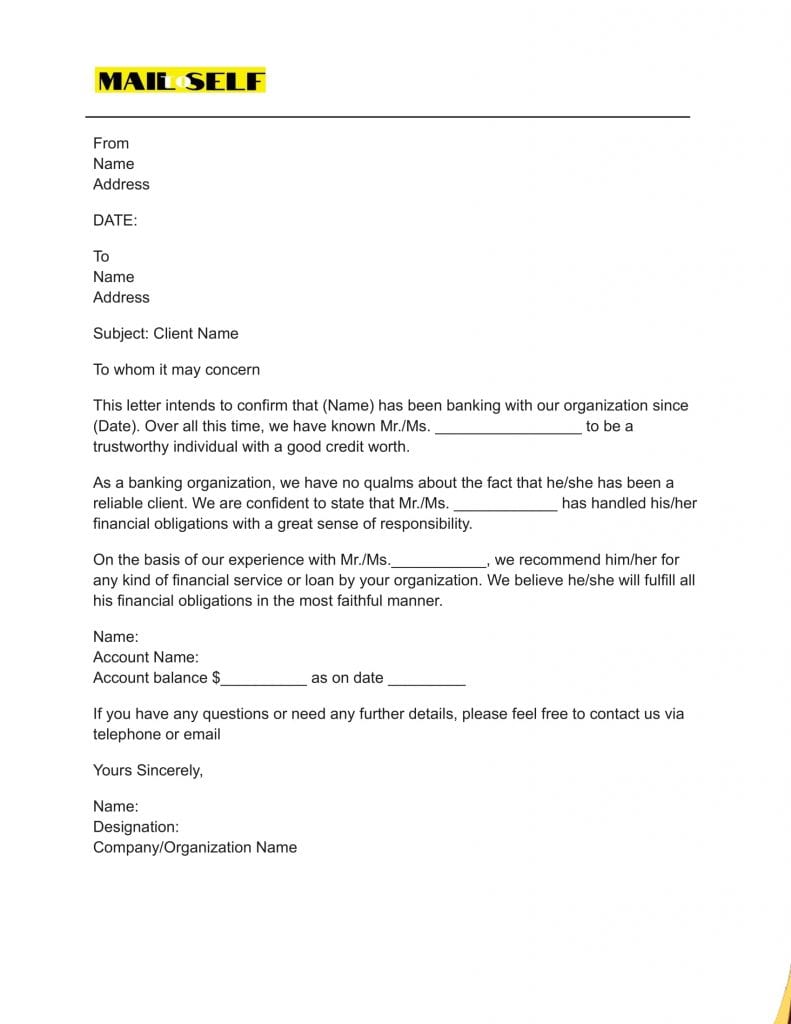

Template #2

From

Name

Address

DATE:

To

Name

Address

Subject: Client Name

To whom it may concern

This letter intends to confirm that (Name) has been banking with our organization since (Date). Over all this time, we have known Mr./Ms. _________________ to be a trustworthy individual with a good credit worth.

As a banking organization, we have no qualms about the fact that he/she has been a reliable client. We are confident to state that Mr./Ms. ____________ has handled his/her financial obligations with a great sense of responsibility.

On the basis of our experience with Mr./Ms.___________, we recommend him/her for any kind of financial service or loan by your organization. We believe he/she will fulfill all his financial obligations in the most faithful manner.

Name:

Account Name:

Account balance $__________ as on date _________

If you have any questions or need any further details, please feel free to contact us via telephone or email

Yours Sincerely,

Name:

Designation:

Company/Organization Name

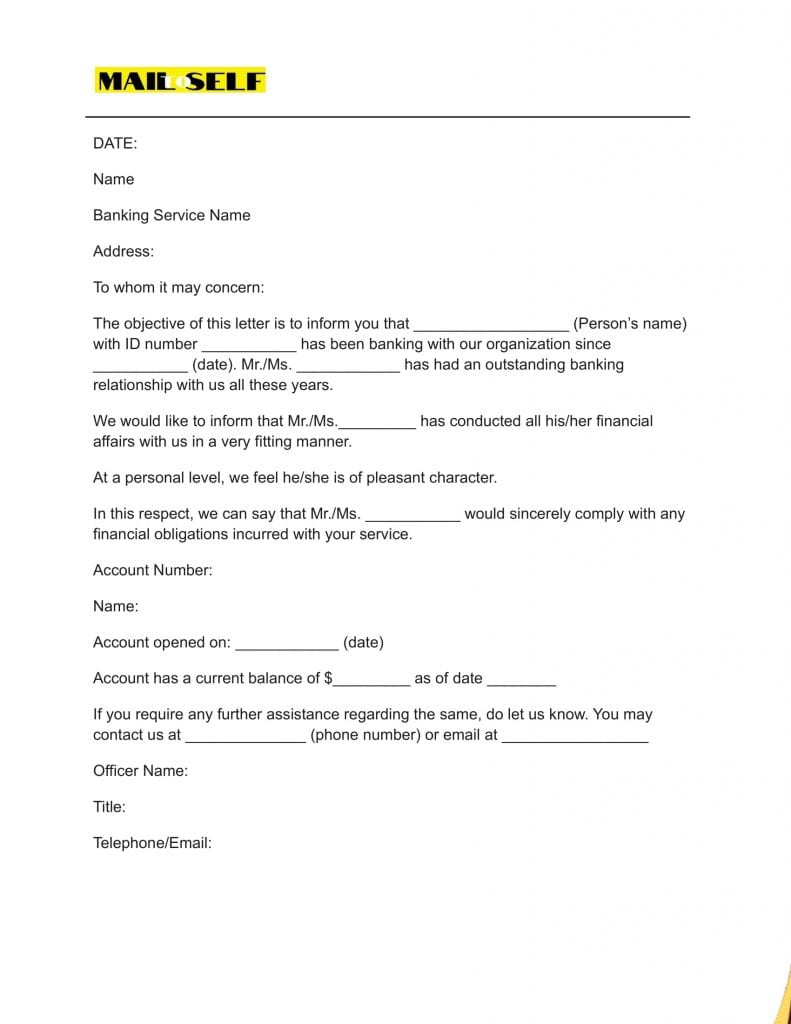

Template #3

DATE:

Name

Banking Service Name

Address:

To whom it may concern:

The objective of this letter is to inform you that __________________ (Person’s name) with ID number ___________ has been banking with our organization since ___________ (date). Mr./Ms. ____________ has had an outstanding banking relationship with us all these years.

We would like to inform that Mr./Ms._________ has conducted all his/her financial affairs with us in a very fitting manner.

At a personal level, we feel he/she is of pleasant character.

In this respect, we can say that Mr./Ms. ___________ would sincerely comply with any financial obligations incurred with your service.

Account Number:

Name:

Account opened on: ____________ (date)

Account has a current balance of $_________ as of date ________

If you require any further assistance regarding the same, do let us know. You may contact us at ______________ (phone number) or email at _________________

Officer Name:

Title:

Telephone/Email:

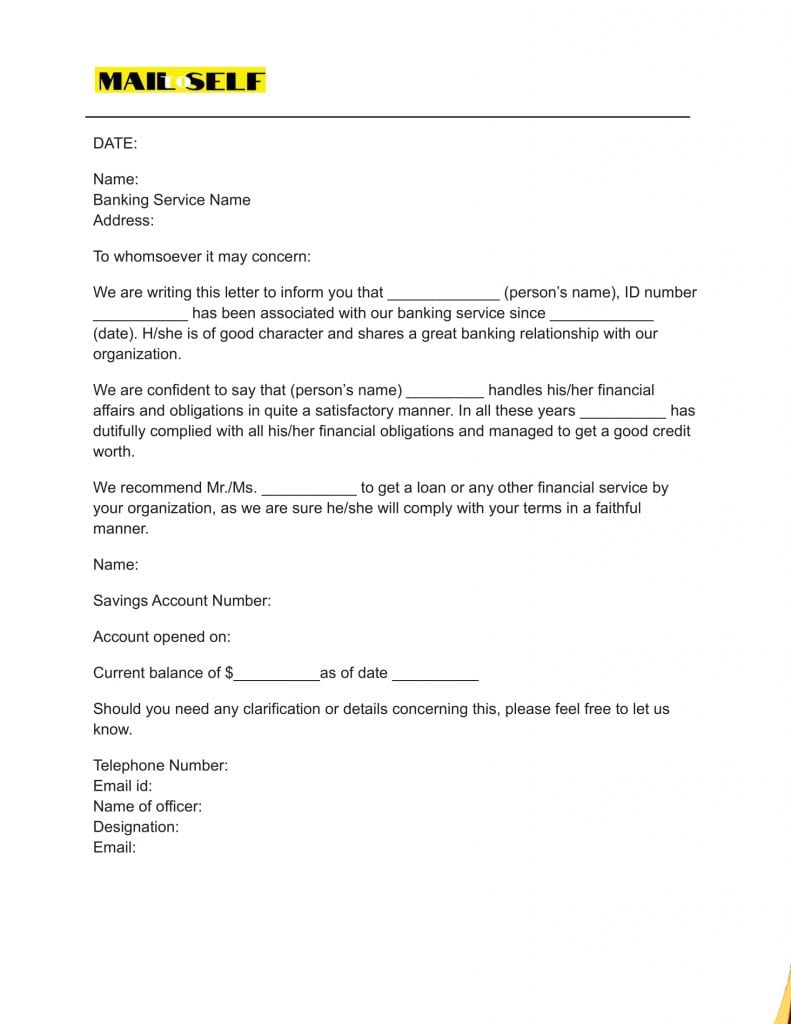

Template #4

DATE:

Name:

Banking Service Name

Address:

To whomsoever it may concern:

We are writing this letter to inform you that _____________ (person’s name), ID number ___________ has been associated with our banking service since ____________ (date). H/she is of good character and shares a great banking relationship with our organization.

We are confident to say that (person’s name) _________ handles his/her financial affairs and obligations in quite a satisfactory manner. In all these years __________ has dutifully complied with all his/her financial obligations and managed to get a good credit worth.

We recommend Mr./Ms. ___________ to get a loan or any other financial service by your organization, as we are sure he/she will comply with your terms in a faithful manner.

Name:

Savings Account Number:

Account opened on:

Current balance of $__________as of date __________

Should you need any clarification or details concerning this, please feel free to let us know.

Telephone Number:

Email id:

Name of officer:

Designation:

Email:

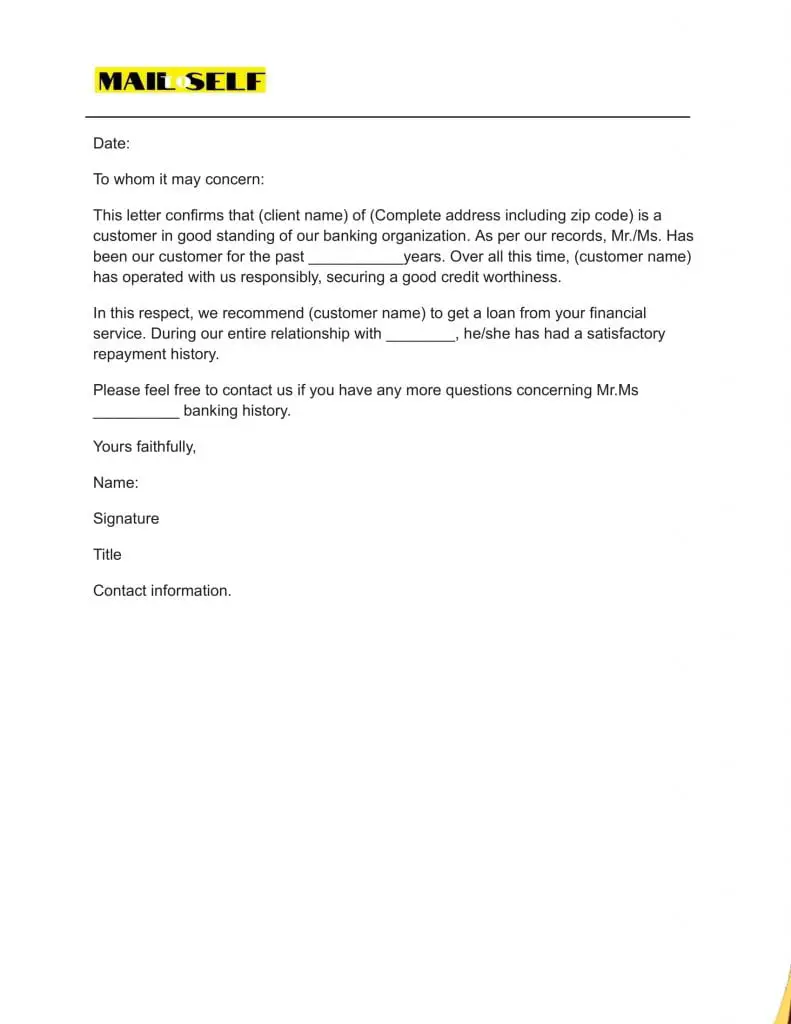

Template #5

Date:

To whom it may concern:

This letter confirms that (client name) of (Complete address including zip code) is a customer in good standing of our banking organization. As per our records, Mr./Ms. Has been our customer for the past ___________years. Over all this time, (customer name) has operated with us responsibly, securing a good credit worthiness.

In this respect, we recommend (customer name) to get a loan from your financial service. During our entire relationship with ________, he/she has had a satisfactory repayment history.

Please feel free to contact us if you have any more questions concerning Mr.Ms __________ banking history.

Yours faithfully,

Name:

Signature

Title

Contact information.

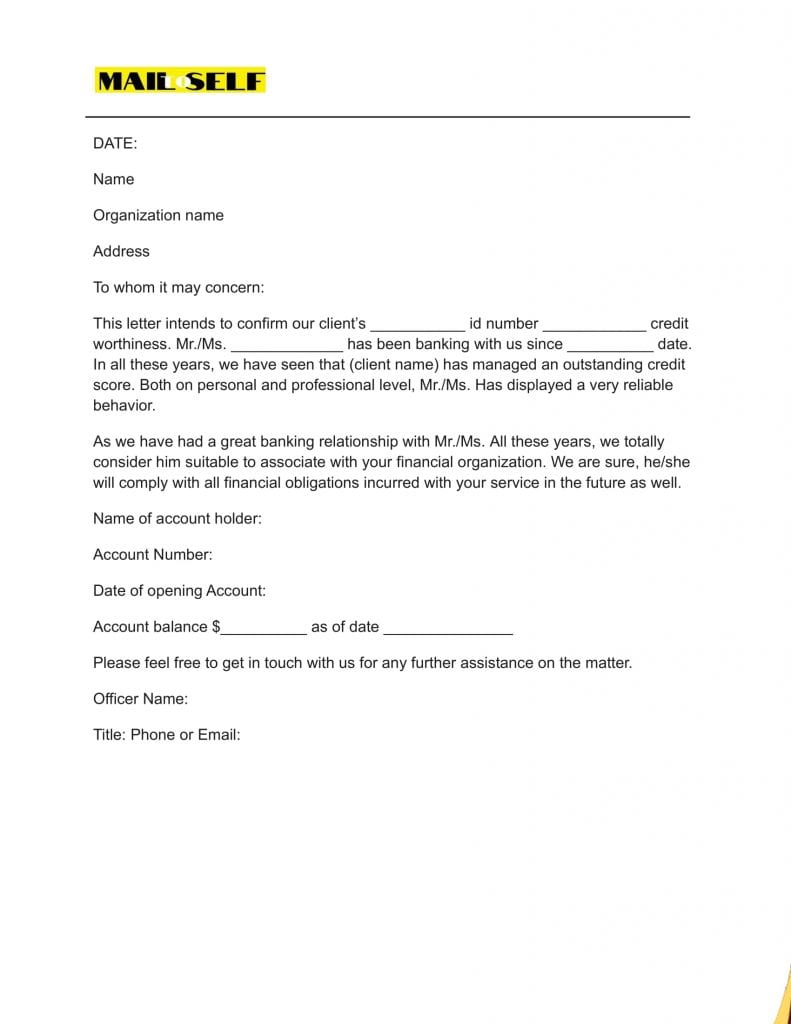

Template #6

DATE:

Name

Organization name

Address

To whom it may concern:

This letter intends to confirm our client’s ___________ id number ____________ credit worthiness. Mr./Ms. _____________ has been banking with us since __________ date. In all these years, we have seen that (client name) has managed an outstanding credit score. Both on personal and professional level, Mr./Ms. Has displayed a very reliable behavior.

As we have had a great banking relationship with Mr./Ms. All these years, we totally consider him suitable to associate with your financial organization. We are sure, he/she will comply with all financial obligations incurred with your service in the future as well.

Name of account holder:

Account Number:

Date of opening Account:

Account balance $__________ as of date _______________

Please feel free to get in touch with us for any further assistance on the matter.

Officer Name:

Title: Phone or Email: